|

2nd Quarter 2002 |

Recession and Credit Quality

|

||||

|

|

Credit quality, sometimes termed asset quality holds a number of managerial

and regulatory issues for banks. From a management perspective, credit must

be priced high enough to cover potential losses, administrative expenses,

etc. yet priced attractively to remain competitive. From a regulatory

perspective, there are potential risks involved and where there are risks,

there are regulations. How does each of these perspectives figure in the

current economic recession? Credit quality, sometimes termed asset quality holds a number of managerial

and regulatory issues for banks. From a management perspective, credit must

be priced high enough to cover potential losses, administrative expenses,

etc. yet priced attractively to remain competitive. From a regulatory

perspective, there are potential risks involved and where there are risks,

there are regulations. How does each of these perspectives figure in the

current economic recession?

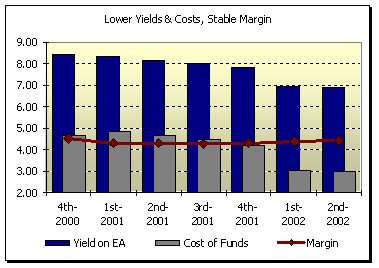

Falling rates have left bank executives scrambling to play the pricing game. Most community banks responded by dropping rates paid on interest bearing core deposits which provided a welcome relief as longer termed assets re-priced somewhat slower. Cost of funds for Peer Group B with assets between $100 and $300 million

fell from 4.68% in the second quarter of 2001 to 3% in the second quarter of

2002. Over time, the asset side of the balance sheet has also responded to

the falling rates and overall portfolio yields are down significantly. A

year ago, yield on earning assets was 8.16% in the second quarter of 2001

for banks in Peer Group B. In the second quarter of 2002, the same peer

group saw yield on earning assets at 6.9%. Interest margins, however, have

increased slightly over the same time period.

Banks industry wide have tightened credit standards in response to the recession. However, in contrast to previous recessions, historically low interest rates and inflated home values have encouraged consumers to continue borrowing. Add to this factor the influx of deposits from the stock market giving banks the money to lend creditworthy borrowers. The banking business as a whole has thus far escaped the economic downturn affecting many other sectors of the economy.

In summary, while the term recession may bring fear to the hearts of bankers and regulating agencies alike, thus far those fears appear unfounded. Further changes in interest rates, trends in corporate earnings and the looming international political landscape will dictate where interest margins will go moving forward. |

|

This

A/L BENCHMARKS Industry Report article was published |