|

1st Quarter 2004 |

Do rising interest rates mean more risk?

|

||||

|

|

When the Federal Open Market Committee (FOMC) meets in June most industry

experts expect the target Fed Funds rate to move up by at least 25 basis

points. Even the Fed Chairman alluded to such “measured increases” in rates

during a speech at his nomination hearing on June 15, 2004. When the Federal Open Market Committee (FOMC) meets in June most industry

experts expect the target Fed Funds rate to move up by at least 25 basis

points. Even the Fed Chairman alluded to such “measured increases” in rates

during a speech at his nomination hearing on June 15, 2004.

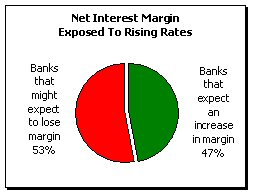

After a long period of historically low interest rates, many community banks could feel some adverse effects as interest rates begin to rise. While many bankers feel that they will be able to boost their margin by keeping deposit funding rates low, they need to keep a watchful eye on the related risks that may arise in the face of rising rates. One way to measure short-term interest rate risk is to measure net interest earnings at risk. Peer data for net interest earnings at risk shows that 47% of FDIC insured banks can expect an increase in net interest earnings if rates rise and that 53% can expect a decrease; a nearly even split. What this measure doesn’t show however are the related risks that may impact the bank’s performance over the next year and beyond. Rising interest rates are also likely to have some adverse impacts on a bank’s asset quality and liquidity position. Rates have already started rising The FOMC’s perspective on rates has also significantly changed. As recently as January 2004, the FOMC stated that the currently low Fed Funds rate could be maintained for a “considerable period.” However in May the FOMC was signaling that “measured” rate hikes were on the horizon. In light of such comments most analysts and the markets believe that the Fed Funds rate could reach 1.75% by the end of 2004. Regulators are concerned Extension risk is the risk that homeowners will decide not to make prepayments on their mortgages to the extent initially expected and instead make only the required payments. As rates rise, there is little incentive to refinance. As the prepayments that were expected do not materialize, the average life “extends” resulting in an investment that is longer in term than originally anticipated. The extension risk inherent in mortgage related products impacts a bank’s ability to earn higher returns as rates rise. The bank has fewer principal cash-flows to reinvest at higher rates and margin may be squeezed by deposits that reprice up quicker.

Also embedded in this growth of mortgage-related products is an increase in the amount of ARM’s and home equity lines of credit. ARMs as a percentage of total refinancings rose from 9.3% in March 2001 to 27.5% by March 2004. Also, home equity lines of credit as a percentage of total assets rose from 2.2% in March 2001 to 3.8% by March 2004. Since these types of loans are typically Prime-based they can work to protect a bank’s earnings if interest rates rise. However, as the FDIC points out, “persistently low interest rates have prompted households to add to consumer debt rather than de-leverage as happened during the last recession. Higher debt levels may present a problem for consumers and households that have come to rely on variable rate debt. Their cash flows may be squeezed by rising interest rates.”1 Such circumstances could create delinquencies or defaults that would ultimately impact the credit quality of a bank’s portfolio.

Obviously the severity of the risks depends on how high and how fast interest rates rise. We already see the impact rising rates can have on the value of securities and loans. In today’s banking industry interest rate risk, asset quality, and liquidity are interrelated. Given the probability of “measured increases” to rates over the next year we are likely to see more vivid reminders of just how interconnected these risks are. 1. FDIC FYI: An Update on Emerging Issues in Banking, November 4, 2004, “Economic Conditions and Emerging Risks in Banking”, http://www.fdic.gov/bank/analytical/fyi/2003/110403fyi.html |

|

Copyright © 2005 Olson Research Associates, Inc. - All Rights Reserved |